Eva was interviewed at ASI regarding the upcoming digital dollar that is being pushed in Washington DC. She shares how the Covid crisis brought her back to the Adventist Church when she saw the rapid deterioration of freedoms all around us.

A trained lawyer, Eva is also an active trader of currencies, equities, and commodities and what she has to share about what is coming is well worth listening to.

The History of FedNow:

In September 2013, the Federal Reserve issued a public consultation paper asking financial institutions in the United States to give their input on how the payment system in the country should be improved. This resulted in the creation of the “Faster Payments Task Force in May 2015.

In July 2017, the task force published its final report which recommended that the Federal Reserve create a fast payment system. The Federal Reserve Bank of Boston was tasked with creating FedNow. The features of FedNow were developed with the help of major financial institutions in the US. These are referred to as the “FedNow community” of over 1600 members. The FedNow community will also decide which features FedNow supports in the future.

From the website:

“The FedNow Service is a new instant payment infrastructure developed by the Federal Reserve that allows financial institutions of every size across the U.S. to provide safe and efficient instant payment services.”

“Through financial institutions participating in the FedNow Service, businesses and individuals can send and receive instant payments in real time, around the clock, every day of the year. Financial institutions and their service providers can use the service to provide innovative instant payment services to customers, and recipients will have full access to funds immediately, allowing for greater financial flexibility when making time-sensitive payments.”

This FedNow platform of providing the infrastructure for instant payments is a giant power grab by the Federal Reserve and will involve a loss of privacy of every person in the US who uses the FedNow service because the Federal Reserve will have access to all the intimate details of your financial life and your earning and spending habits. This is totally unconstitutional and is a violation of the 4th amendment right to privacy.

The 4th Amendment states:

“The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no Warrants shall issue, but upon probable cause, supported by Oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized.”

Presently and historically, if the government wanted to see your bank records to know how you’ve spent your money, they would need to get a warrant, pursuant to the 4th amendment right against unreasonable search and seizure.

Right now, participation in FedNow is voluntary. However, if you voluntarily use the FedNow service, you waive your 4th amendment right to privacy. That is an important point that I’m not sure people realize. You should want to preserve your privacy as much as possible and not voluntarily give up your 4th amendment right to privacy for the sake of convenience. So, I would caution people NOT to use the FedNow service and do NOT do business with banks or other organizations that use the FedNow instant payment system. The FedNow website has a list of organizations that are certified participants in the FedNow instant payment system (26 financial institutions, 11 settlement agents and liquidity providers, and 17 certified service providers).

Here is a list of the banks that are participating in FedNow as of today.

The FedNow digital payment system will likely lead to the ushering in of a US CBDC/Digital Dollar.

The Fed makes it clear on its website and in published statements that it envisions that the FedNow platform will have additional features programmed into it. They could include features such as placing limits on your spending or freezing your spending power, and it could program into the FedNow platform a supervisory control over where and on what your currency can be spent, just as with a CBDC.

CBDC:

1. President Biden’s Executive order 14067: President’s March 9, 2022, Executive Order on Ensuring Responsible Development of Digital Assets, which facilitates the research and development of digital assets, including converting the U.S. monetary system to a central bank digital currency (CBDC).

2. What the government wants to do with CBDCs will affect the financial life of every one of us, and most people do not even know about it. CBDCs are essentially a digital prison that is disguised as money.

3. The implementation of CBDCs will turn America into a communist country OVERNIGHT with no vote, no say in the matter, and no shots fired.

4. *What are CBDCs? CBDCs are fully programmable, fully traceable digital currency that is centralized and distributed by a government or its central bank. Because it is centralized to one authority, as opposed to being decentralized, it is fully controlled and programmed by the authority that issues it. What does this mean? This means the government can control when, where, and upon what you can spend the currency.

5. What is true freedom? True freedom is financial freedom, which is the freedom to conduct whatever financial transactions you choose to conduct; to spend your money as you please; or to save as much of your money as you deem appropriate. CBDCs (central bank digital currencies) are an attack on our freedom. In fact, CBDC’s will be the end of freedom.

Let’s Look at the Difference Between Cash and CBDCs

a. Cash:

i. Cash transactions offer the secrecy and anonymity that is necessary to have financial freedom.

ii. People can use cash to make transactions without leaving a paper trail, which is a fundamental right in a democratic society

iii. Cash does not expire.

iv. Cash is not dependent upon electricity or network coverage. You can use cash when the power is out or in the event of a network outage.

v. Cash cannot be stolen in a cyber-attack.

vi. Cash is physical. You can hold it in your hand.

vii. When you hold cash, you own cash.

b. CBDCs/Digital Dollar:

i. CBDCs are digital, not physical, meaning that you will not be able to access your money when the power is out or when the network is down.

ii. They ARE the death of anonymity. There will be no privacy in your financial life and financial transactions.

1. In fact, Federal Reserve Chairman, Jerome Powell confirmed in September 2022 during an event hosted by the Bank of France that CBDCs would not be anonomous: He stated,

““If we were to pursue a CBDC, it would at a minimum have the following four characteristics,... “First is intermediated. Second is privacy protected. But third is identity verified. So, it would not be anonymous. It would not be an anonymous bearer instrument. And fourth is transferable or interoperable. So, we would be looking to balance privacy protection with identity verification, which has to be done, of course, in today's traditional banking system.”

iii. CBDCs would be fully traceable and tied to your digital ID, meaning that every transaction would be recorded and monitored by the central bank. This would allow central banks to surveil and control financial transactions in ways that were previously impossible. This will be government SURVEILLANCE of all US citizens’ financial transactions. This is the antithesis of freedom.

iv. The currency is programmable, meaning that the government and/or central bank will set the rules as to how, when, where, and on what items that currency can be spent.

v. In October 2020, the BIS General manager, Agustin Carstens, described the difference between cash and digital currency, as follows– “The Central Bank will have ABSOLUTE CONTROL on the rules and regulations that will determine the use of that expression of central bank liability and it will have the technology to ENFORCE that.” – Bank of International Settlements (BIS) General Manager, Agustin Carstens

vi. Steve Forbes has warned that CBDCs or “Government digital cash is a formula for TYRANNY.” –Steve Forbes

vii. If the Federal Government wanted to outlaw or further restrict the sale or purchase of guns, a further attack on our 2nd Amendment rights, it could program the CBDC such that it could not be used to purchase guns.

viii. We live in a consumption-based economy. If the government decides that the country’s economic numbers are too weak, ie, if the government wanted to increase the consumer spending numbers and decides that consumers are not spending enough or are saving too much of their money, the government and the Federal Reserve could program the CBDC to expire within 30 days, forcing us to spend the money and convert it to goods before the money evaporates.

ix. At the International Monetary Fund (IMF) Spring Meetings 2023, the Digital Currency Monetary Authority (DCMA) announced their official launch of an international central bank digital currency (CBDC), Universal Monetary Unit (UMU).

1. Universal Monetary Unit (UMU), symbolized as ANSI Character, Ü, is legally a money commodity, can transact in any legal tender settlement currency, and functions like a CBDC to enforce banking regulations and to protect the financial integrity of the international banking system.

2. Banks can attach SWIFT Codes and bank accounts to a UMU digital currency wallet and transact SWIFT-like cross-border payments over digital currency rails completely bypassing the correspondent banking system at best-priced wholesale FX rates and with instantaneous real-time settlement.

x. It was recently reported a few days ago, that a developer discovered a hidden feature in Brazil’s central bank digital currency (CBDC) that allows the government to freeze funds and even adjust balances.

xi. In China, financial services are NOW being denied to its citizens based upon their social credit score, which is a function of what the citizens post/share on social media. That could be easily implemented here in the US with a CBDC.

6. The Federal Reserve Bank of New York has stated that its “innovation hub” is conducting CBDC prototyping with various major banking institutions

In July 2023, the Bank of International Settlements (BIS) reported that its 2022 Survey of 86 Central Banks revealed that 93% of those Central Banks Are Working on a CBDC. The BIS estimates that by 2030, there could be 15 retail CBDCs and 9 wholesale CBDCs in circulation.

The BIS Plan for a Global Unified Ledger and Tokenization of all Privately Held Assets

On June 20, 2023, the Bank of International Settlements (BIS) released a chapter of its annual report titled, “Blueprint for the future monetary system: improving the old, enabling the new.”

The BIS claims that “a new type of financial market infrastructure – a unified ledger – could capture the full benefits of tokenisation by combining central bank money, tokenised deposits and tokenised assets on a programmable platform.”

This would be fully programmable and fully controlled by the Central Bank. That is the key danger that and the key aspect that would give totalitarian control of all of your deposits, stocks, securities and personal assets, like your home and your car, to the government and the Central Bank.

This is a huge power grab by the central banks, and by the Bank of International Settlements, an international organization where we, as American citizens, have no voting power.

The BIS claims that having a unified ledger containing your tokenized privately held assets would improve existing processes through the seamless integration of transactions.

They state clearly in their report that a unified ledger could “harness programmability to enable arrangements that are currently not practicable, thereby expanding the universe of possible economic outcomes.”

The PROGRAMMABILITY of the platform, of the unified ledger, and of the CBDC, as well as tokenization of all privately-held assets, and centralization of those privately-held assets in a unified ledger, are the key aspects of their plan which will enslave the world in a unified system of totalitarian control by the BIS and/or your country’s Central Bank.

The report's authors look down upon the decentralization of the monetary system that we have heretofore enjoyed, by referring to it as “silos” which stand in the way of centralized total control and programmability to enforce that control of every person and participant in the monetary system. However, it is decentralization and the existence of these “silos” that protect our freedom and sovereignty of the individual. Decentralization is necessary for our personal freedom and sovereignty.

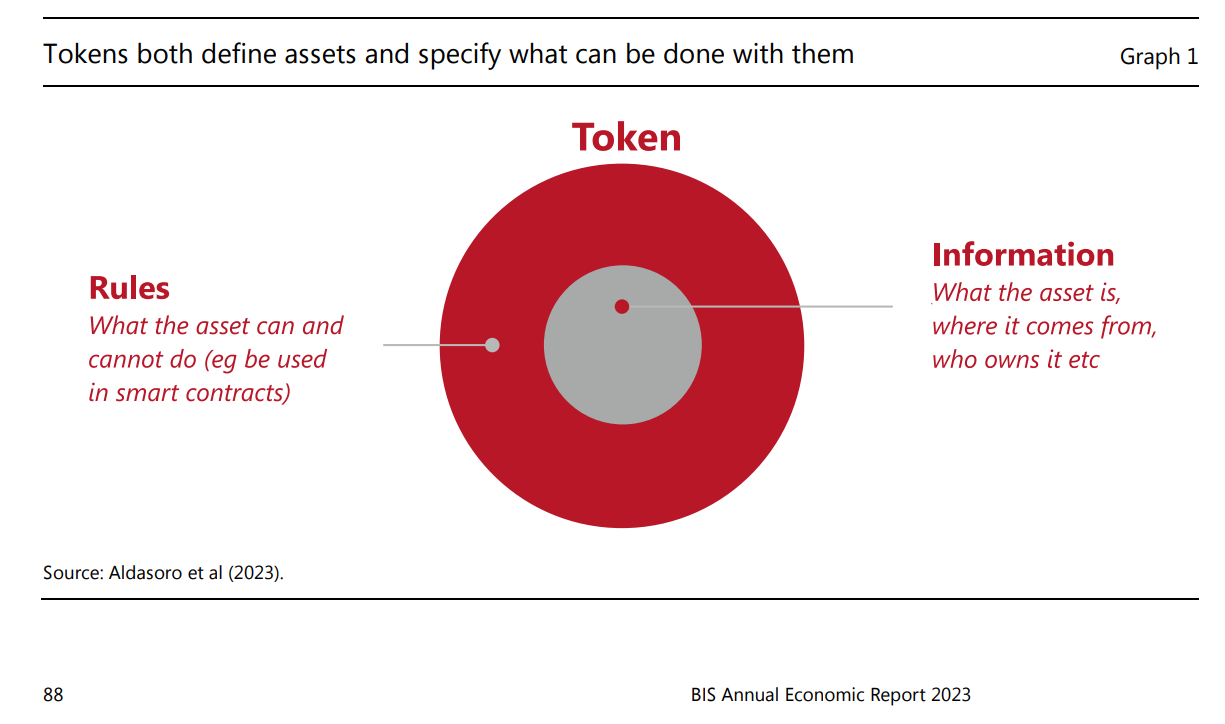

The report explains the tokenization process, as follows (emphasis added):

The claims traded on programmable platforms are called tokens. Tokens are not merely digital entries in a database. Rather, they integrate the records of the underlying asset normally found in a traditional database with the rules and logic governing the transfer process for that asset (Graph 1). Hence, whereas in traditional systems the rules that govern the updating of asset ownership are usually common to all assets, tokens can be customised to meet specific user or regulatory requirements that apply to individual assets. We discuss in a later section how this dual nature of tokens could be used to good effect in a supervisory and compliance setting by directly embedding supervisory features into the token itself, which can be tailored to specific rules. Tokenisation – the process of recording claims on financial or real assets that exist on a traditional ledger on a programmable platform – introduces two important capabilities. First, by dispensing with messaging and the reliance on account managers to update records, it provides greater scope for composability, whereby several actions are bundled into one executable package. Second, it enables the contingent performance of actions through smart contracts, ie logical statements such as “if, then, or else”. By combining composability and contingency, tokenisation makes the conditional performance of actions more readily attainable, even quite complex ones.3”

The report goes on to state that a unified ledger “features money and assets as executable objects, which means they could be transferred safely and securely without going through external authentication and verification processes and without relying on external messaging systems.4”

The report also states (p. 96) that the unified ledger would have a “data environment” component that would include “all information necessary to incorporate real-world events into any contingent performance of actions. Information can be a direct result of transactions on the ledger or may be obtained from the outside environment.” What does that mean? This language suggests that real world events could potentially affect your ownership of an asset once it is tokenized on the global unified ledger.

How Can we Push Back on CBDCs and the “Control Grid”?

7. Advice on how we can push back on CBDCs and the “control grid” the globalists are trying to impose on us through CBDCs and Digital IDs/Vaccine Passports:

a. Although we can push back on this new financial control system that is sought to be imposed on us, ultimately, we will likely not be able to stop it because the Bible predicted that this would happen and will happen eventually. Revelation 13:17 implies that there will be a beast power that has total control over your ability to buy or sell. The book of Revelation reveals that the beast power will seek to impose the Mark of the Beast on every person on earth. Accepting the Mark of the Beast will bring eternal death. It is up to each of us instead to choose to serve God, to love God, keep his commandments, and to have the faith of Jesus, and in that we will be saved and sealed by God to live and to be given eternal life with God in heaven. Accordingly, we must ACT NOW to build our relationship with God in order that we will have the faith strong enough to withstand tremendous financial pressures without compromise.

b.

d. Find and use a local community bank for your banking, a bank that is NOT participating in the FEDNOW instant payment system. And let the bank officials KNOW that this is why you are choosing to use their bank.

e. If the CBDC control grid system is put into place:

i. They can mandate that any, and all shots, and booster shots must be taken. They will have the ability to turn off our money if we don't comply.

ii. They would be able to turn off our money if they don't like our political views, or

iii. If they don't like what we post on social media.

iv. They will turn off our money if they don't like our religious views.

v. CBDCs and the tokenization of all privately held property on a global unified ledger would place all of us in a digital prison.

f. Above all else, however, Jesus is coming. We need to be prepared. We live in a fantastic time. These things foretold in the book of Revelation are coming true. We know that the things foretold in Revelation are coming true because we know that Revelation 13:17 states, “And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.”

g. We know that the book of Revelation states that no one will escape the choice of taking either the mark of the beast or having the seal of God. All will have to make this choice.

h. We need to prepare ourselves to receive the seal of God and not the mark of the beast, and we need to be ready to meet Jesus. Do not be afraid. "Fear not" is stated 365 times in the Bible. John 16:33: “These things I have spoken unto you, that in me ye might have peace. In the world ye shall have tribulation: but be of good cheer; I have overcome the world.”

i. Let us not worry about what is coming, but let us prepare ourselves. Let us place our faith in God and in Jesus NOW, and be sealed in God's word, and fear God and keep His commandments.

j. Prepare those around you. Be of comfort to others when the hard times come. God will protect us and sustain us, if we Honor Him!.

During the COVID plandemic, we got a very small taste of the authoritarianism and outright tyranny that the global elites, the World Economic Forum, The Bank of International Settlements, Central Banks around the world, and the Biden Administration is eager to exact upon us.

We can make some contingency plans and position ourselves to weather the storm in the best possible way, but the Bible makes it clear that at some point, we will be totally reliant upon God.

****

Eva J. Tompkins, Esq. is a licensed attorney in the State of New York. She practiced law for 19 years before retiring from the active practice of law to start her own business in the area of finance. In her business, she is an active participant in the financial markets and an active trader of currencies, equities, and commodities. She trades in the spot foreign exchange market and the futures market. As such, Eva constantly monitors the activity and monetary policies of the Central Banks around the world.